How Blockchain Helps SWIFT, the King, to Hold Its Throne

SWIFT, the financial network connecting 11,000 banks in 200 countries, knows that harnessing blockchain is crucial to maintaining its dominance

The biggest global payments network that handles almost all international payments in the world, SWIFT, is working to harness blockchain to help it stay on top.

SWIFT has fully embraced blockchain as a way to improve efficiency and cut costs.

What comes next is a new payment system and new ways of doing business. Don’t fall behind.

SWIFT Is The Most Important Piece of the Global Financial System That You’ve Probably Never Heard Of

SWIFT is the most important financial network in the world, connecting over 11,000 banks in over 200 countries. It started life as a messaging network for handling international payments during the 1970s, back when banks used telex machines. Pretty much any time a bank from one country wanted to send a payment to a bank in another country, they sent a message over the SWIFT network. That’s still true today, and SWIFT handles over 40 million messages with an estimated value of $5 trillion per day (but they don’t much use telex machines anymore, although I bet they have a few around for old-time’s sake.)

SWIFT was relatively unknown outside of banking circles until the Sanctions against Russia over the Ukraine Invasion thrust it into the headlines.

SWIFT Needs to Keep Innovating to Keep Up With an Ever More Complex Global Economy

International payments are complicated.

Under the hood, what happens when Nia the New Yorker sends money to Sven the Stockholmian is that the US Banks and the Swedish banks have to coordinate with each other. First, the money moves from Nia's bank to a "correspondent bank."

Next, the correspondent bank verifies the deposit, and then a corresponding transaction happens in Sweden, where the correspondent banks transfer money to Sven's account. This gets complicated fast, with multiple intermediaries:

Notice that this requires coordination between the two banking systems and setting up several parallel transactions. That’s a lot of messages going back and forth, lots of moving parts, and thus lots of opportunities for mistakes and delays.

Meanwhile, SWIFT is under constant pressure to make the system work faster: How happy are you when you have to wait for a payment to clear? How sympathetic are you when a payment is delayed?

SWIFT Has Been Working On Blockchains for Six Years

To keep its dominant position, SWIFT has been working since 2016 on several projects focused on cutting costs, eliminating errors, and improving processing speed and efficiency.

In 2016, SWIFT started releasing papers on its work on using blockchain to improve the payment system:

Swift and Accenture outline path to Distributed Ledger Technology adoption within financial services

Distributed Ledgers, Smart Contracts, Business Standards and ISO 20022

The concept here is to replace a system with multiple parties sending messages to each other, who then have to reconcile their records, with one where all the parties share a single common set of records, a “distributed ledger.”

SWIFT has pioneered a system using CBDCs, or Central Bank Digital Currencies (more on those below), running on a blockchain to manage these payments while cutting out a lot of moving parts:

But to do this at scale requires automation, aka "smart contracts" and to use those at scale requires 100% trustworthy verification of messages. 100% trustworthy verification that, e.g., yes, the deposit made it from Nia's bank to the correspondent bank.

Here Jonathan Ehrenfeld of SWIFT talks with Chainlink CEO Sergey Nazarov about their five-year relationship with Chainlink and their newly announced joint pilot project.

Jonathan Ehrenfeld Solé of SWIFT on the 5 year journey to work with Chainlink to build on blockchain

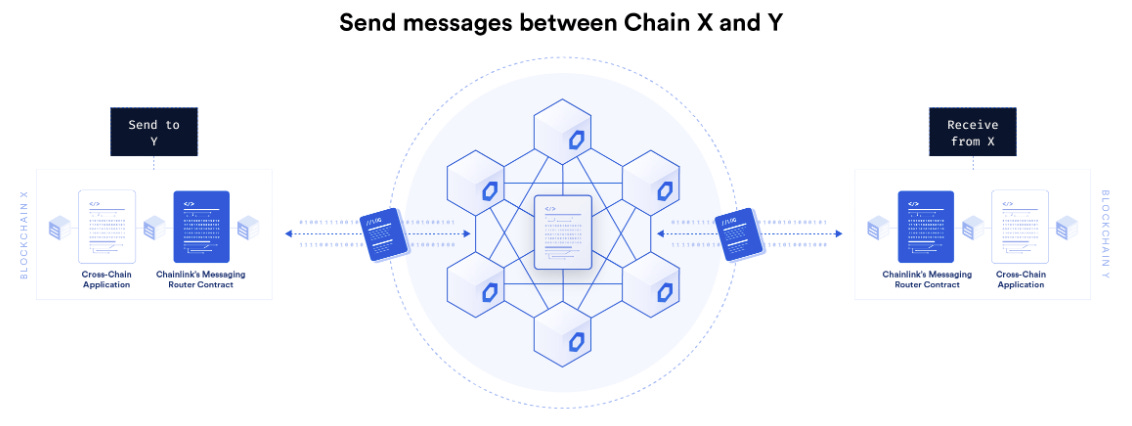

This is a pilot of Chainlink’s Cross-Chain Interoperability Protocol, a system that uses distributed oracles to allow messages to be send across and between multiple networks.

SWIFT continues to experiment with using blockchain, for example, to handle the aforementioned Central Bank Digital Currencies and (2) tokenized assets. For more on CDBDs and privacy, see our earlier pieces here:

For more on Tokenization, see our earlier piece:

Next Up: SWIFT Will Continue to Dominate

While there are rivals, SWIFT has a long head start and, crucially, an established reputation with thousands of banks and other institutions all over the world.

Although there are other message services . . . SWIFT continues to retain its dominant position in the market. Its success may be attributed to how it continually adds new message codes to transmit different financial transactions

Why Is SWIFT Dominant, Investopedia (emphasis added).

SWIFT's main advantage though is that its existing network is already usable in over 200 countries and connects more than 11,500 banks and funds.

SWIFT sets out blueprint for central bank digital currency network, Marc Jones, Reuters.

While there are sure to be rival approaches, whether from Russia, China, or other blockchain upstarts, SWIFT will win. No one has the reach of SWIFT. There are banks around the world still using faxes and keeping records on paper, and they know how to use SWIFT. They are comfortable with it. It’s part of their process.

This is a useful example of an important path to blockchain adoption: when a legacy network with a strong reputation, and lots of strong relationships, adopts blockchain as a way to improve the performance of its existing network. Another example, by the way, is various intermediaries, such as the DTCC in the United States, which handles stock trades, but we’ll leave that for another time.

SWIFT’s Adoption of Blockchain Will Be a Major Step Forward for the Global Financial System and for Blockchain

SWIFT’s work in international payments gets most of the press, but its reach extends far beyond that.

From the early days, the SWIFT system proved so effective and so efficient that banks — the original participants, realized that they should use the system for domestic payments too. Then the securities firms started adopting SWIFT as well. Today more than half of the messages on the SWIFT network involve securities transactions, not payments.

And it’s not just working with banks and financial institutions. Large corporations, such as Microsoft and GE, have joined the SWIFT Network and use it as their single standardized connection to all their banks around the world.

SWIFT is at the center of huge changes happening in the global financial system, which is moving towards a new data standard, ISO 20022, for which SWIFT is the standard bearer. A full discussion of ISO 20022 will have to wait for another post, but suffice it to say that ISO 20022 will exponentially increase the amount of data flowing around the financial system, and the rise of ISO 20022 and blockchain will be mutually reinforcing, just like the railroads and the telegraph networks.

The biggest companies and the biggest financial institutions in the world work with SWIFT every day. When SWIFT makes a change, they’ll see it and adopt it, just like they have over the past several decades. This will be blockchain’s big moment. It’s happening sooner than you think.

Practical Pointers

Payments are going to change -- but don’t worry, this only matters if your business or organization uses money. But if it does, these changes to the financial system will improve your cash flow management, will make it easier to check for fraud, and will make international payments simpler. Do you have a plan in place?

This is happening, it's just starting, but major adoption of blockchain is happening. It will happen in two ways: gradually and then all of a sudden. If you have been waiting to convince your skeptical boss that blockchain is for real, show her what’s happening with SWIFT. It’s time to get out ahead of what’s coming.

If you haven’t already, start thinking about how your systems work. Where in your process is your business sending messages back and forth all day? Where are you spending lots of time reconciling your accounts with your customers or suppliers? Follow SWIFT’s lead and start thinking about where you could replace all those moving parts with a single shared ledger.

Questions or comments? Please leave them below.

If you found this helpful, I’d be grateful if you could share it with anyone else who might find it interesting.

If someone shared this with you, and you want to know more about how blockchain and smart contracts are transforming our world, subscribe to my free weekly newsletter (comes out every Wednesday).