Why Tokenization is Set to Become the First Trillion-Dollar Blockchain Breakthrough

A technology called "tokenization" -- that uses blockchain to slice, dice, recombine and reconstruct assets in brand new ways -- will transform the economy.

Image of golden jigsaw puzzle generated by DALL-E 2 from OpenAI based on prompts from LawSnap

Tokenization is a new way, using blockchain, to track ownership of almost any asset, whether an oil tanker, a painting, a patent, or a floor in an office building.

Tokenization solves many problems for both buyers and sellers by making markets more flexible, more transparent, and more liquid.

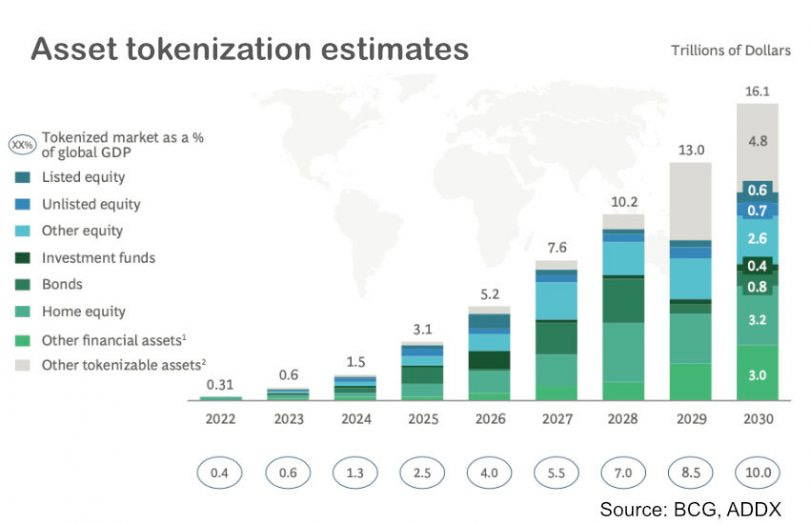

Although tokenization faces barriers to adoption, there is widespread demand, including from huge financial players, for the benefits it brings, and it is likely to hit $1 Trillion in value by 2024 and $10 Trillion by 2028.

Tokenization is a New Way to Buy and Sell “Fractional Shares” of an Asset

Imagine owning 3% of a painting, selling 5% of the 9th floor of an office building, or buying 12% of the royalties earned by a song over the next three years. All of these are possible with “tokenization” — splitting an asset up and representing the pieces by tokens on a ledger.

Fractional Ownership Means Buying and Selling Pieces Rather than the Whole Asset

In other words, tokenization is the latest, more flexible example of “fractional ownership,” where multiple parties own an asset. The most familiar example of fractional ownership is owning shares in a corporation like ExxonMobil or Walmart. In that case, many thousands of shareholders each hold a small piece of the asset, i.e. the corporation. Other examples of fractional ownership would be a Real Estate Investment Trust, better known as a REIT, that allows multiple shareholders to hold fractional ownership of real estate, or Mortgage-Backed Securities, where each investor holds a portion of the right to payment from a group of mortgages.

Tokenization Use a Distributed Ledger to Increase Transparency and Efficiency

So the theory isn’t new, but the implementation is. The way tokenization works is the asset, say a painting, is broken up into multiple pieces, and each of those pieces corresponds to a “token,” which is recorded on a blockchain. The “blockchain” part means that the tokens are listed on a ledger, which is, essentially, just a list of who owns what. The ledger is maintained by a large decentralized, network of computers. Each computer on the network keeps its own copy of the full ledger and watches every other computer on the network, to make sure that every computer agrees on who owns what. Each computer also tracks every time someone buys, sells, or otherwise sells each token. Because the ledger is “distributed” among the whole network, it's called a “Distributed Ledger,” and “Distributed Ledger Technology” or “DLT” refers to a system built on a Distributed Ledger.

Tokenization Makes the Market Work Better for Both Buyers and Sellers

Tokenization has the potential to make life better for buyers and sellers by increasing options for both and making the system work better for both sides of the transaction.

Increases liquidity: It gives asset holders new opportunities to convert their assets into cash, aka it increases liquidity. We say an asset is “illiquid” if it is difficult to convert into cash.

Say Carla the Collector owns a famous painting worth $100,000 and she needs money. She'd like to sell the painting, but at any given moment, there aren't a lot of people around who are prepared to put up that much in cash. In other words, the market is "illiquid".

But imagine if she could sell a "fraction" of her ownership in the painting. There might be a lot more folks willing to spend 1000 to own 1 percent of the asset. Tokenization also makes it easier for Carla to borrow against the asset, by creating a more liquid, transparent market for tokens in an asset, it is easier for borrowers and lenders to assess its value, and also lenders are more likely to lend at attractive rates if they know they have easy access to the collateral. So, for example, a lender knows that if the borrower defaults, it is easier to get access to tokens than, say, getting access to a painting.

Broadens access: Today, many asset classes are available only to a restricted few, mostly the super-rich and large institutions. These assets include private equity, commodities, fine art, real estate developments, land, vintage cars, and livestock. Tokenization will change this by creating more liquid markets where smaller investors can also participate.

Makes transactions faster, cheaper, and more efficient: Today, many transactions take a few days to settle. It’s not like going to the grocery store where you pay your money and walk out with your milk. Assets get passed through several intermediaries, and there are a lot of moving parts. Mostly this works fine, but every once in a while, there is a problem that can lead to delays, or, worse, a failed transaction. The idea of “real-time settlement” is that it’s more like going to the grocery store.

Increases transparency and decreases fraud: with certain types of assets, say rare artworks, fakes, frauds,and forgeries are a constant risk. And delays in transactions (see point number 3) make fraud easier. Tokens on blockchains make the whole system more transparent. Not only can every party get access to the ledger (remember: it’s “decentralized” aka “distributed,” but each buyer can see the entire transaction history and chain of title.

The Tokenization Market Is Set to Hit $1 Trillion in 2024

Pilot tokenization projects are popping up all over the place, particularly in two areas: real estate and securities transactions.

On the real estate side, many pilot projects are popping up, many with a focus on “broadening access” i.e. making investments possible that were previously available only to big institutions and to high-net-worth individuals. See Moore Global says tokenized real estate could reach $1.4 trillion in five years.

Regarding securities transactions, the focus has been less on “broadening access” and more on making transactions faster, more efficient, and more reliable. Some of the biggest financial companies in the world, including banks like JP Morgan, Goldman Sachs, Investment companies like Blackrock and KKR, and financial intermediaries, like DTCC, are all moving quickly to set up projects for tokenization. See BlackRock CEO Says ‘Next Generation for Markets’ Is Tokenization.

Nonetheless, as with any new technology, there are potential obstacles. Possible barriers to adoption of tokenization include:

Regulatory Uncertainty: It’s not clear exactly how regulators in the U.S. and Europe will treat tokenized assets. And, of course, not all tokenized assets are the same. Regulatory uncertainty is particularly difficult for tokenized assets because, in theory anyway, they are global. The idea is that tokens can be sold in exchanges all over the world. So, regulatory uncertainty is even more of a problem with cross-border transactions.

Technology risks: in the grand scheme of things, blockchain is still a relatively new technology. And as with every other form of technology, hacking is a risk. And because much of the blockchain is managed by smart contracts, i.e. autonomous, independent software, this may increase security in some ways but reduce it in others, as it creates new ways for hackers to exploit.

Lack of interoperability: Nobody wants to put their assets into a system and not be able to get them back out. At the moment, many DLT systems are kind of “walled gardens,'' and it’s not always easy to connect one to the other, or to connect legacy systems to a DLT system. The good news is that many, including Chainlink labs, are working hard on this problem. See our piece Blockchain To The Rescue -- How We Can Fix Our Fragmented Banking System on efforts to use blockchain to improve interoperability.

Lack of scale: many blockchain systems cannot yet handle the volume required. Many smart people are working hard on this problem as well, but we’ll leave that for another day.

Nonetheless, the momentum appears to be on the side of the “tokenizers.” BCG estimates that the market for tokenized assets is going to exceed 1 trillion in 2024, and 10 trillion by 2028.

BCG (@BCG) and ADDX (@ADDXco), Relevance of on-chain asset tokenization in ‘crypto winter’

Watch this space.

In the meantime, if you found this interesting, please subscribe to “LawSnap by Adam David Long” my weekly newsletter — published every Wednesday.